Sprinkling the Magic - Cordant Shares Wealth

The Cordant Group, a massive recruitment business with a substantial FM services arm has become a Social Enterprise. Meaning the majority of the Group's profits will...

Read Full Article

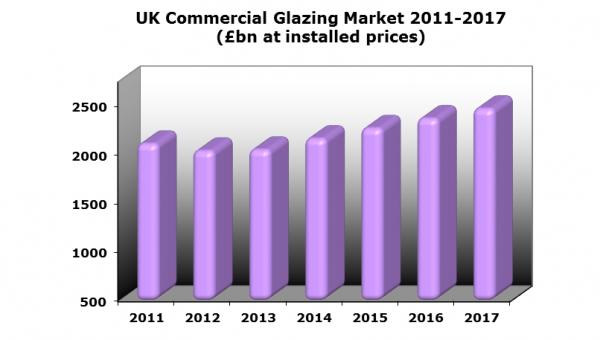

Following a difficult period, an AMA report shows that the commercial glazing market will grow by 5% this year.

The report found that growth in 2014/15 has been mainly driven by rising demand in the office construction sector and by late-2015 there are signs of growing demand for new Grade A office space in London as well as other cities which is likely to stimulate growth for commercial glazing from 2016 onwards.

Construction output in the education sector has also been strong in 2014/15 which may be surprising given the public sector capital budget cutbacks. The education sector is also likely to see growing demand with the introduction of the Priority Schools Building Programme (PSBP) in England as the replacement for BSF which should deliver £2.5 billion worth of new schools to complete by 2017 and the University Technical Colleges programme and similar schemes in Scotland and Wales.

The report found that not all sectors are performing well. In healthcare, the shift away from building large hospitals towards smaller primary care facilities has meant less demand for curtain wall, roof glazing and windows.

The decline in High Street retailing – as well as in retail parks and out-of-town developments – will probably continue as online shopping continues to penetrate the market. In addition, the grocery multiple sector is also experiencing a major cutback in store development programmes which will have ‘negative implications for the glazing industry’.

Product sectors

In terms of product sectors, commercial windows is the largest sector accounting for over 50% of sector sales with curtain wall and ground floor treatments both substantial markets.

Demand for curtain walling has been particularly buoyant in 2014/15 – growing by around 10% per annum and driven primarily by a recovery in office construction – particularly in London.

Roof glazing accounts for the smallest share at less than 10%, though rooflights are in demand for both commercial and domestic applications. Aluminium is still the dominant frame material in the commercial glazing market but timber, PVC-U, steel and composites all have reasonable shares and sector strengths.

On the supply side, some product sectors have seen relatively little change other than some smaller companies going out of business and among the systems companies, the market has remained fragmented with no truly dominant suppliers.

“In the aluminium systems supply sector, the market is broadly split with the 10 largest accounting for around 90% of this market,” stated Andrew Hartley, Director, AMA Research. “However, more difficult market conditions in 2012-2013 has led to a significant contraction among fabricators and installers with several players ceasing trading, though order books have improved in 2015.”

Private sector

The report believes that key to medium term growth will be continued recovery for the private commercial construction sector which is forecast to be the main driver for growth into the medium term and should ‘more than offset the less positive performance of the public sector’.

As a result, the market outlook for commercial glazing in key application areas in office construction continues to offer the best areas for growth in the near to medium term future, though the leisure/entertainment construction sector also has good opportunities.

The commercial glazing market is forecast to have grown by 5% in 2015 with further growth of 4-5% forecast for 2016. Forecasts are for more moderate, but steady, underlying annual growth at 3-4% from 2017-19 and AMA’s report highlights differences between sectors which will have implications for contractors, product and material suppliers in different markets.

*The Commercial Glazing Market Report – UK 2015-2019 Analysis report is published by AMA Research. For further information, visit the website: www.amaresearch.co.uk

Picture: The latest AMA research into the commercial glazing market predicts a 5% growth for 2015.

Article written by Mike Gannon | Published 12 November 2015

The Cordant Group, a massive recruitment business with a substantial FM services arm has become a Social Enterprise. Meaning the majority of the Group's profits will...

Read Full ArticlePart of the Mayor of London, Boris Johnson’s ‘big idea’ on energy awards celebrate private sector businesses that have made the biggest difference to...

Read Full Article