Kier Komes Krashing Down

The Kier Group's shares have been plummeting in a style reminiscent of Carillion and Interserve - and on Monday June 17 things got worse as the construction and FM...

Read Full Article

A snap poll of Carillion engineering sub-contractors shows that many companies are facing huge financial losses from the collapse of the construction giant. That’s according to new data obtained by the Building Engineering Services Association (BESA) and the electrotechnical and engineering services trade body ECA.

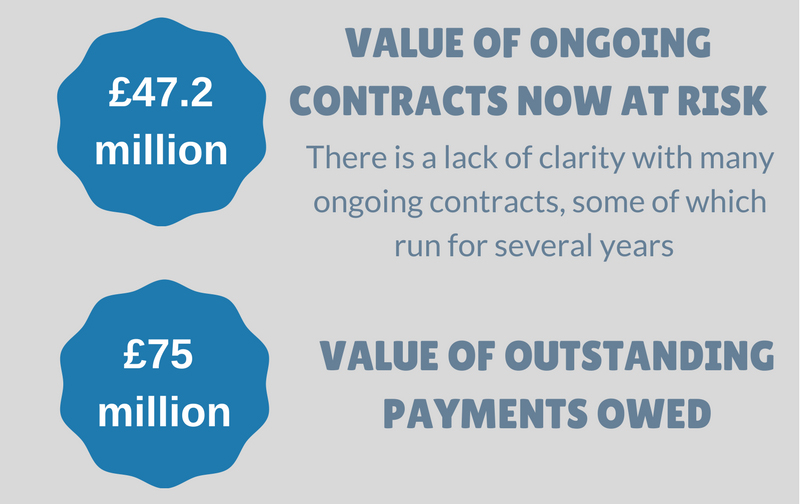

Carillion owes around £75 million to around 80 engineering services firms, who provide vital services such as electrical, plumbing, gas, fire and security, and heating and ventilation. The overall losses are likely to be far higher, given there are thousands of businesses operating in the industry. The engineering services sector is the largest part of the construction industry by value.

The ECA and BESA survey shows that contractors of all sizes have been affected by Carillion’s demise:

BESA and ECA have met with liquidator PwC and the Government. PwC said any private sector work undertaken by Carillion suppliers before 15 January this year would be unpaid. Instead, it would be treated as ‘unsecured debt’, and placed at the back of the queue behind other creditors.

“We knew the fall-out from this seismic episode would be extremely serious, but these figures give us a clearer picture of just how hard our sector is going to hit in terms of the thousands of pounds of unsecured debt that will be lost by ordinary hard working small businesses, jeopardising their future and the future of their staff,” said BESA President Tim Hopkinson.

“These findings underline the need for concerted action from the Government and banks to protect and support SMEs in the construction and services sector. The Government should also introduce legal measures to ensure SMEs are not continually exposed to upstream insolvency,” commented ECA Director of Business Paul Reeve.

Both ECA and BESA have long called for reform to unfair payment practices within construction. Carillion was widely known to take over four months to pay suppliers, despite 30 day payment being industry good practice. To tackle this slow payment, the two trade bodies are calling on the Government to pay small and medium-sized businesses directly, using ‘project bank accounts’.

BESA and ECA are also supporting a Bill tabled by Peter Aldous MP, which is currently going through Parliament. The Bill will prevent clients and main contractors, such as Carillion, from using their own accounts to store money held back from suppliers in case of defects – ring-fenced, independent accounts would be used instead.

Picture: Infographic - The ECA and BESA survey shows that contractors of all sizes have been affected by Carillion’s demise

Article written by Brian Shillibeer | Published 25 January 2018

The Kier Group's shares have been plummeting in a style reminiscent of Carillion and Interserve - and on Monday June 17 things got worse as the construction and FM...

Read Full ArticleBESA President Claire Curran said the government’s “flip flopping” on net-zero and infrastructure policy should not be used as an excuse to delay...

Read Full ArticleA trial involving the former Carillion Chair and interim CEO has been cancelled by the Insolvency Service, as proceedings are “no longer in the public...

Read Full ArticleBig Four accounting firm KPMG has been fined for “exceptional” breaches when auditing the now-liquidated FM company Carillion. The initial £30...

Read Full ArticleRichard Howson, former CEO of the now-defunct FM company Carillion, has been banned from holding directorship roles for eight years. The charge relates to...

Read Full ArticleThe Financial Reporting Council has fined KPMG £14.4 million for providing misleading information during an audit of former construction and facilities management...

Read Full ArticleThe Building Engineering Services Association (BESA) says it has carried out a thorough review of the security procedures behind its online training schemes...

Read Full ArticleContractors and insurers must work together to ensure the rising cost of professional indemnity insurance does not undermine efforts to improve building safety, according...

Read Full ArticleIn addition to the FRC tribunal regarding the 2016 Carillion audit, KPMG is now being sued by the government for £1.3 billion. According to released court...

Read Full ArticleJonathan Holt has apologised for KPMG misleading the Financial Reporting Council during an investigation into the firm’s 2016 audit of the now-defunct FM company,...

Read Full Article