- Content

- News

- Interserve To Rise Like A Phoenix From Ashes Of Fire Sale?

18 March 2019

Administrators were appointed to Interserve Plc on Friday March 15 - within minutes, the entire Group's business and assets were sold to a newly incorporated company to be controlled by the Group's lenders.

Interserve's Board of Directors had warned that if its deleveraging plan was voted down, it would act quickly to preserve what little value was left in the company - effectively a threat that the company would go in to administration. The plan was voted down and by 12:35pm, Ersnst & Young's Alan Hudson and Hunter Kelly had signed off on a 'pre-pack' sale.

The deleveraging plan had involved asking the company's lenders to write off an element of debt and then issuing more shares to raise capital for operational purposes and to pay down loans. The company's major shareholder, Coltrane Asset Management (which owned 27% of shares), had advocated resisting the plan and returning to lenders to insist they wrote off more debt. (Under the delevaraging plan, shareholders, including Coltrane, would have only realised about 5% of any remaining value between them with the company's lenders owning the rest.)

The Board attempted to rally support from smaller shareholders but failed. Those shareholders will now have lost what little value that was left. Despite the Board telling its 68,000 employees (45,000 in the UK) that Monday March 18 will see 'business as usual', it is anticipated that contractors and supply chain creditors will bit hit hard.

It is believed the beneficiaries of the Group's pension schemes have been protected.

The banks that now own Interserve have swapped their debt (£485 million) for full equity and will provide up to an additional £110 million of additional loans. The new owners include HSBC and the Royal Bank of Scotland along with investors Emerald Asset Management and Davidson Kempner Capital.

On Friday 15, CEO Debbie White said: "Under new ownership, the Group will have a strong balance sheet, competitive financial structure and a fundamentally solid foundation from which to deliver on its long term strategy."

Administration

Ernst & Young LLP had already been briefed as administrators to Interrserve Plc and so were able to move quickly on Friday March 15 to 'sell' the Group (not the Plc) to a recently incorporated company, Montana 1 Limited. Montana 1 will be renamed Interserve Group Limited.

Shares cancelled

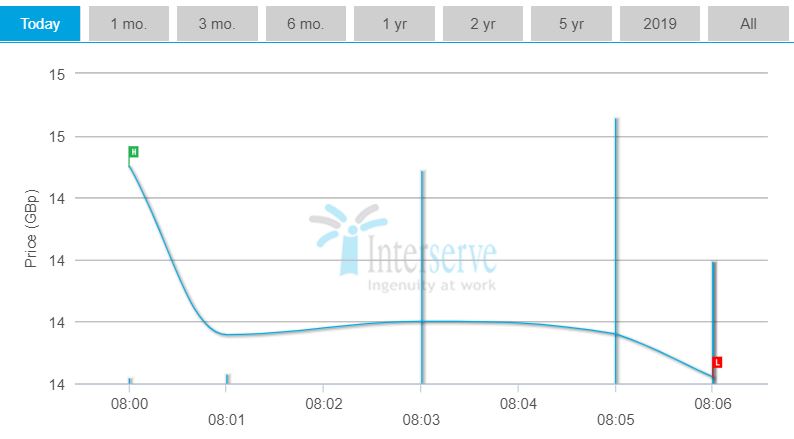

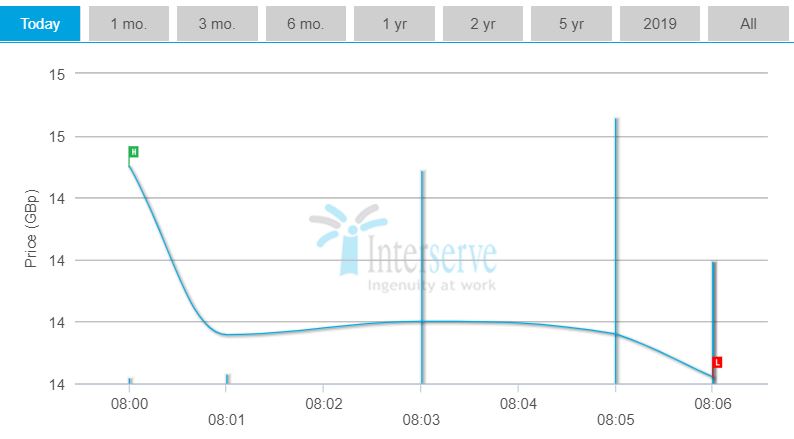

Interserve requested that its shares were suspended from sale at the London Stock Exchange as at 12.35pm on Friday March 15. The cancellation was expected to take place at 8:00am on March 18.

Shares for sale

ThisWeekinFM has learned that Interserve Group's shares could start trading again (on the FTSE Fledgling Index) as early as March 20. Despite Debbie White's assertion that 'Interserve is fundamentally a strong business that with a competitive financial platform in place can be a best-in-class partner to the public and private sector,' it would be no surprise if the Group's new owners started to divest shares in short order.

Statement

A statement on the operating website reads: 'Interserve (in administration) has announced the successful completion of the sale of the group. This alternative deleveraging transaction will restore the Group’s balance sheet and provide additional liquidity. The administrators have immediately sold Interserve’s business and assets to a new company, to be controlled by Interserve’s lenders.

'All companies in the Group other than the parent company will remain solvent, providing continuity of service for customers and suppliers.

'The alternative transaction involves the equitisation of approximately £485 million of existing debt and the injection of £110 million of new money into the Group.

'Completion of the transaction is anticipated to occur on or before Monday 18 March'.

Hanging on the telephone

The statement continues: 'The Group believes this is the best remaining option to preserve value, protect the jobs of employees and ensure the Group can carry on as normal with minimal disruption.

'If you are an Interserve Employee, Customer or Supplier and you have a question, you can contact us on our dedicated hotline 0333 207 4180 which is open from 07:00 – 19:00 until Monday 18 March.

Picture: Ersnst & Young's signed off on Interserve Group's 'pre-pack' sale to lenders within minutes of shareholders rejecting a plan that would have seen the value of their holdings fall to just 5%.

Previous reporting

News has reached ThisWeekinFM on Friday March 15 at 1pm that Interserve’s Shareholders have rejected the deleveraging plan proposed by the Board and thus the firm is expected to be placed in to administration by this evening.

The vote went approximately 60:40 in favour of rejecting the plan, with major shareholder Coltrane (27 per cent) leading the challenge. Coltrane had wanted Interserve’s directors to alter the deleveraging plan and seek greater write-offs from the company’s banks and other lenders.

The Board had tried to rally smaller shareholders to support its plan with the veiled threat that they would seek alternative arrangements to secure the remaining value for shareholders and creditors, which ultimately meant administration. With the loss of the vote the Board are expected to call in administrators, likely to be Ernst & Young, today.

Interserve’s shares (standing at 6.30 GBP) have been suspended from trading.

Previous reporting

Interserve's 'de-leveraging' strategy appears to be in tatters and the company, which employs 68,000 people around the world, is likely to find itself in administration before the weekend if a vote goes against the Board's plan.

Interserve's latest plan to fend off creditors and ultimately a Carillion style collapse were thought to have been agreed in principle with all of the company's lenders, bonding providers and the Pension Trustee. However, this morning, the BBC has reported that the plan (which was to swap the majority of the company's huge debt for new shares) requires the support of more than 50% of the shareholders. Interserve's biggest shareholder is US hedge fund Coltrane. Coltrane is said to be not willing to approve the plan.

The BBC report says Interserve directors have said the comapny has 'a mountain to climb' to prevent the firm from collapsing under the weight of a nearly £650 million debt.

ThisWeekinFM recently reported that Interserve's debt actually stood at £600 million. The new share issue would have looked to cut that to £275 million - but with current shareholders left with next to nothing as their existing shares were devalued.

Interserve's shares fell on Monday March 11 from 14.5GBp to 13.82GBp between 8:00am and 8:06am.

In May 2018 the company's shares hit 111.30GBp on 4 February 2019 they were at 11.49GBp. On the morning of February 6, they were up to 16GBp (on the announcement that the latest deleveraging plan had support). In January 2015 shares were worth at their high, 705.50GBp

Glimmer of light

Although all shareholders are likely to lose the vast majority of any value left in Interserve, the Board does have one glimmer of hope - and that is for small shareholders to vote in favour of the deleveraging plan. Coltrane's holding is 27%, thus it is still possible to raise enough votes to push the deal through against Cotrane's wishes.

Vote called

A General Meeting has been called for March 15 to vote on the deleveraging plan. Interserve's Board have declared: 'It is the only plan today that is capable of being implemented, preserving some value for shareholders'.

Administration - the alternative?

A Board statement continues: 'The company is in a critical financial situation. If shareholders do not support our plan we have taken steps to prepare for an alternative transaction to protect the business and preserve value for our creditors customers and our suppliers'.

Jobs risk

The statement adds: 'The Board considers the deleveraging plan to be in the best interests of Interserve and all its stakeholders, including shareholders, as a whole. Our plan preserves some value for shareholders. This will not be the case if the proposals are voted down. It is the only plan with the support of all of our lenders and the Pension Trustee. It is a plan that secures the future of a business that, with a firmer financial footing, will be successful. It is a plan that secures 68,000 jobs, pensions and public services'.

Administration could be best

Although Interesrve going in to administration and its assets being sold off to repay the company's lenders - one analyst (quoted by the BBC) is of the opinion that if the Interserve group companies can retain their order books as sold-off separate entities but unhindered by debt, they could all trade very efficiently - avoiding the a Carillion-style disaster...creditors, shareholders and sub-contractors may not see this in the same positive light.

Picture: Interserve's international business was recently awarded ADNOC contracts worth £9.6 million and ThisWeekinFm recently reported that RMD Kwikform, Interserve's global formwork, falsework and ground shoring company is the Group's most profitable arm - perhaps supporting the view that Group companies could thrive better without being burdened by Group debt.

Article written by Brian Shillibeer | Published 18 March 2019

Share

Related Articles

Interserve Reaction - Firm Given £Millions In Public Contracts Despite Nationalisation Plan

Interserve was handed £233 million worth of public sector contracts in recent months despite being on a government 'watch list' set-up to avoid...

Read Full Article

Interserve – The Latest

It was reported that in mid-May that Interserve was involved in a cyber attack, involving the theft of information on current and former Interserve...

Read Full Article

Kier Komes Krashing Down

The Kier Group's shares have been plummeting in a style reminiscent of Carillion and Interserve - and on Monday June 17 things got worse as the construction and FM...

Read Full Article

Interserve's £90m A Year Auditors Under FRC Investigation

The Financial Reporting Council (FRC) has commenced an investigation into the audit by Grant Thornton of the financial statements of Interserve Plc for the years ended 31...

Read Full Article

Comedy Of Kier's Colossal Mis-Calculation

Monday March 11 saw the Kier Group with red faces over an accounting 'error' that added over £50 million of debt to the outsourcer's trading statement...

Read Full Article

Interserve Shareholders Left With Almost Nothing After Rescue Plan Agreed

Interserve's latest plan to fend off creditors and ultimately a Carillion style collapse have been agreed in principle with all of the company's lenders, bonding...

Read Full Article

Not Quite Out for The Count - Interserve Off The Canvas...Just!

Global FM and building firm, Interserve, saw its share value plummet yet again on the morning of December 10. Having fallen to 6p (from a 2014 position at 700p), they...

Read Full Article

Interserve - Basic Failings In Basic Maintenance. Troubled Firm Hit With Huge Bio Hazard Fine

Emergency generators failed and one caught fire when they were called in to use. Interserve has been fined after multiple safety failings could have caused a serious bio...

Read Full Article

Interserve To Suffer Complete Loss Of Power

ThisWeekinFM contacted Interserve on Wednesday Feb 21 morning when a spokesperson confirmed the closure of the company's power business.

The spokesperson said:...

Read Full Article

Trial of Carillion Chair and CEO Cancelled

A trial involving the former Carillion Chair and interim CEO has been cancelled by the Insolvency Service, as proceedings are “no longer in the public...

Read Full Article

.gif)

.gif)

.gif)

.png)