Another Furlough Extension - What Happens Now?

The Coronavirus Job Retention Scheme has been officially extended until 31 March 2021, but what else do employers need to know? Alan Price, CEO of BrightHR, explains...

Read Full Article

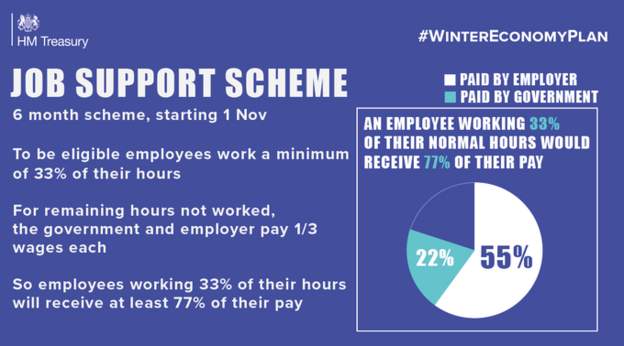

In a speech in the Commons today, Chancellor Rishi Sunak has announced a new Job Support Scheme to help protect employment once the current furlough scheme ends.

The scheme will start in November, and employees who are working 33 per cent of their hours will be eligible. The government and the employer will make up the cost of hours not worked, paying one-third each.

The scheme for self-employment will continue, and a “pay as you grow” scheme for businesses which took out government loans will also begin, giving people longer to pay them back.

The cut in VAT to 5 per cent for the hospitality and tourism sector will be extended until 31 March.

It has also been confirmed that this year’s Budget has been postponed.

“The primary goal of our economic policy remains unchanged - to support people’s jobs - but the way we achieve that must evolve.”

–Rishi Sunak

UK Chancellor

Picture: a graphic provided by the Treasury, demonstrating that employees working 33 per cent of their hours will receive 77 per cent of their pay.

In addition, the government extending the Self Employment Income Support Scheme Grant (SEISS). An initial taxable grant will be provided to those who are currently eligible for SEISS and are continuing to actively trade but face reduced demand due to coronavirus. The initial lump sum will cover three months’ worth of profits for the period from November to the end of January next year. This is worth 20 per cent of average monthly profits, up to a total of £1,875.

An additional second grant, which may be adjusted to respond to changing circumstances, will be available for self-employed individuals to cover the period from February 2021 to the end of April.

As part of the package, the government also announced it will extend the temporary 15 per cent VAT cut for the tourism and hospitality sectors to the end of March next year.

In addition, up to half a million business who deferred their VAT bills will be given more breathing space through the New Payment Scheme, which gives them the option to pay back in smaller instalments. Rather than paying a lump sum in full at the end March next year, they will be able to make eleven smaller interest-free payments during the 2021-22 financial year.

On top of this, around eleven million self-assessment taxpayers will be able to benefit from a separate additional 12-month extension from HMRC on the “Time to Pay” self-service facility, meaning payments deferred from July 2020, and those due in January 2021, will now not need to be paid until January 2022.

More than a million businesses who took out a Bounce Back Loan will be able to take advantage of the new Pay as You Grow flexible repayment system.

This includes extending the length of the loan from six years to ten, which will cut monthly repayments by nearly half. Interest-only periods of up to six months and payment holidays will also be available to businesses.

The treasury also intends to give Coronavirus Business Interruption Loan Scheme lenders the ability to extend the length of loans from a maximum of six years to ten years if it will help businesses to repay the loan.

In addition, the Chancellor also announced he would be extending applications for the government’s coronavirus loan schemes until the end of November.

Picture: a graphic showing a person holding an umbrella with the words "winter economy plan" over the image

Article written by Ella Tansley | Published 24 September 2020

The Coronavirus Job Retention Scheme has been officially extended until 31 March 2021, but what else do employers need to know? Alan Price, CEO of BrightHR, explains...

Read Full ArticleFrom 1 September 2020, businesses using the Coronavirus Job Retention Scheme will have to pay ten per cent of their furloughed employees’ wages. The...

Read Full ArticleRishi Sunak has today provided a recovery plan to stimulate the economy, including a Job Retention Bonus for employers. Sunak also introduced a three-point plan for...

Read Full ArticleAlmost half (44 per cent) of furloughed FM professionals are anxious about their return to work, according to recruiter Randstad. A poll of almost 8,000 workers from...

Read Full ArticleAs Chancellor Rishi Sunak reveals this year’s Budget, what are the main points that facilities managers should be aware of? The annual Budget is set by the...

Read Full ArticleThe UK government has removed the minimum limit of vacancies employers need to create to apply to the Kickstart Scheme. Previously, there was a need to create a...

Read Full ArticleCBRE is the latest commercial real estate firm to announce that it will return all furlough payments claimed during COVID-19. The company will also allegedly top-up...

Read Full ArticleThe TUC is calling on employers to offer furlough to all parents affected by the closure of schools, as all secondary schools will remain closed this week. The union...

Read Full Article£215m of furlough funds have been returned to the government in circumstances where they were mistakenly claimed, or entirely unnecessary. HMRC have recorded...

Read Full ArticleThe government has said that up to £3.5bn may have been fraudulently or mistakenly claimed under the Coronavirus Job Retention Scheme. Speaking to the Commons...

Read Full Article